When you were gathered around the TV with friends and family getting ready to celebrate the beginning of the New Year, I am sure that the last thing on your mind was your budget. I get it; budgeting is not fun or exciting, but it is one of the most important things to put in place in your journey to financial freedom.

The beginning of the year is the optimal time to take some time to reflect on what it is that you would like to accomplish over the course of the next twelve months. Would you like to retire? Purchase a new home or a vacation home? Pay down debt? Increase your retirement savings? Whatever your goals are, the first thing that you need to do is to review your budget. Understanding how you are spending your money will allow you to make the necessary changes so that you can align your spending with your goals and objectives. If you do not have a budget in place, then there is no better time than now to start.

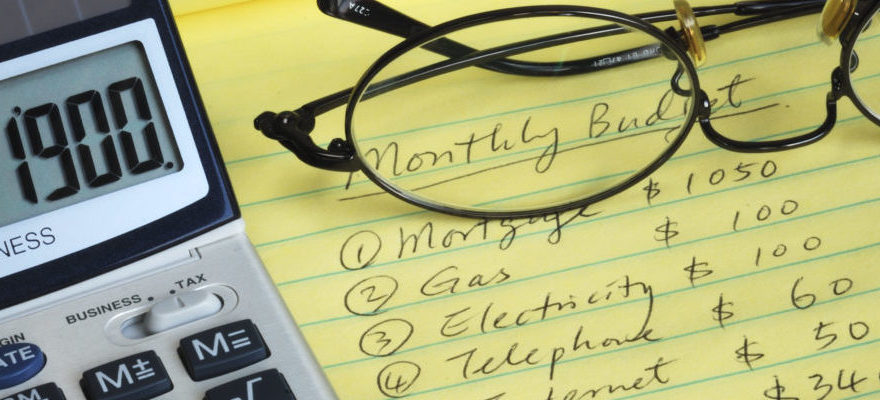

The first step in budgeting is determining where you are spending your money. Therefore, it is critical to track your expenses, because it is only then that you can understand where your money is going. If you do not know where your money is going, then you will most likely have a difficult time making changes to your spending habits going forward. It is typically easier for many people to have a good understanding of their fixed expenses (e.g. mortgage, rent, utilities, car payment, cell phone, etc.) because they tend to be the same amount from month to month. However, an area where most people struggle is understanding the number of their variable expenses. Variable expenses are those expenses that change from month to month (e.g. groceries, dining out, entertainment, clothing, etc.) Having a tracking system in place will allow you to stay on top of both your fixed expenses and variable expenses, providing you with the vital information you need in order to achieve your goals. There are a variety of ways to track expenses (pen and paper, a spreadsheet, or a software program).

At Zynergy Retirement Planning, we recommend our members to utilize Mint.com. Mint.com is a free service that allows you to link your various checking accounts and credit cards so that you can get a comprehensive view of your total spending. Once you have all your accounts loaded into the software, take a look at your spending over the past twelve months. Is your spending consistent with your goals, objectives, and values? If so, you are on the right path to financial freedom. However, if your spending is not in-line with your goals you now have all the information that you need to make the necessary changes to get where you want to be. It is also important to note that you should monitor your budget over the course of the year. You do not want to create it and then walk away. Life happens and there will be changes to your financial situation over the course of the year. Incorporating these changes into your budget will help you remain on target to accomplish your goals.